Stanbic Bank Tanzania Loans interest rates and Eligibility, Stanbic Bank Tanzania Loans requirements, Stanbic Bank Tanzania Loans Eligibility, sifa za kupata mkopo Stanbic Bank Tanzania

Stanbic Bank Tanzania offers a variety of loan products designed to meet the diverse financial needs of individuals and businesses. This article explores the different types of loans available, the interest rates associated with them, and the eligibility requirements for prospective borrowers.

Types of Loans Offered by Stanbic Bank Tanzania

Stanbic Bank provides several loan options to cater to different financial needs:

- Unsecured Personal Loans:

These loans are meant for personal use, allowing customers to borrow without providing collateral. They can be utilized for various purposes, such as medical expenses, education, or home improvements. - Home Loans:

Aimed at those looking to buy or improve their homes, these loans typically require a deposit and offer competitive interest rates. - Vehicle and Asset Finance:

This option allows customers to finance the purchase of vehicles or other movable assets, with flexible repayment terms tailored to individual situations. - Payday Loans:

Short-term loans designed for urgent cash needs, offering quick access to funds with minimal documentation. - Salary Advances:

Designed for employees who need immediate cash flow, these loans are repaid through salary deductions.

Interest Rates on Stanbic Bank Loans

Interest rates on loans from Stanbic Bank Tanzania vary based on the type of loan and the borrower’s credit profile. Generally, interest is calculated daily and debited monthly. For unsecured personal loans, the interest rate is based on the bank’s lending base rate plus a margin that reflects the borrower’s risk profile.

Examples of Interest Rates:

- Unsecured Personal Loans: The interest rate is competitive but varies based on individual circumstances.

- Home Loans: Typically offer lower rates compared to unsecured loans due to collateral.

- Vehicle and Asset Finance: Interest rates are personalized based on affordability assessments.

Example of Interest Rate Calculation

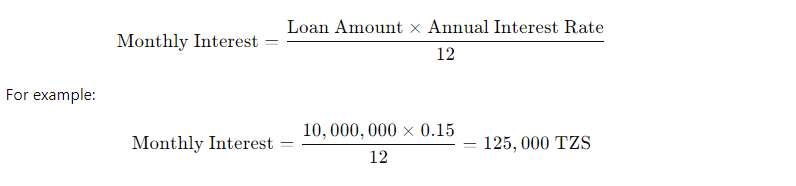

Interest on loans is calculated as follows:

For loans in Tanzanian Shillings (TZS), interest accrues based on a 365-day year. If a loan of TZS 10 million is taken at an interest rate of 15% per annum, the monthly interest would be calculated as:

This calculation helps borrowers understand their monthly financial obligations.

Eligibility Requirements for Loans

To qualify for a loan from Stanbic Bank Tanzania, applicants must meet specific criteria:

- Age: Applicants must be at least 18 years old.

- Citizenship: Must be a Tanzanian citizen or a permanent resident with valid identification.

- Income: A minimum gross monthly income is typically around TZS 1.5 million for personal loans.

- Bank Account: Applicants must have an active current account with Stanbic Bank where their salary is deposited regularly.

- Credit History: A good credit history is essential; the bank will assess past borrowing behavior through credit reference bureaus.

Application Process

The application process for Stanbic Bank loans is straightforward:

- Documentation: Applicants need to provide identification documents, proof of income (such as pay slips), and any other required documentation.

- Loan Application Form: Complete an application form detailing personal information, employment history, and financial status.

- Approval Process: After submission, the bank will review the application and conduct a credit assessment before granting approval.

Final thoughts

Stanbic Bank Tanzania offers a range of loan products designed to meet various financial needs while maintaining competitive interest rates and flexible repayment options. Understanding the eligibility requirements and the application process can help prospective borrowers navigate their options effectively.

By providing accessible financial solutions, Stanbic Bank supports individuals in achieving their personal and professional goals through responsible borrowing practices. Whether you need funds for home improvement, vehicle purchase, or urgent cash flow needs, exploring Stanbic Bank’s offerings could be a beneficial step toward fulfilling your financial aspirations.