Jinsi ya Kupata TIN Namba Yangu ya Biashara| How to Get My Business TIN Number, How to Get My Business TIN Number in Tanzania: A Step-by-Step Guide, Jinsi ya kupata TIN namba ya biashara,

Jinsi ya kupata TIN namba ya biashara online

Obtaining a Business Tax Identification Number (TIN) in Tanzania is an essential step for entrepreneurs. To get a Business TIN, one must register through the Tanzania Revenue Authority’s online portal, where the process can be completed quickly, often within 24 hours. This number is crucial for tax compliance and allows businesses to operate legally within the country.

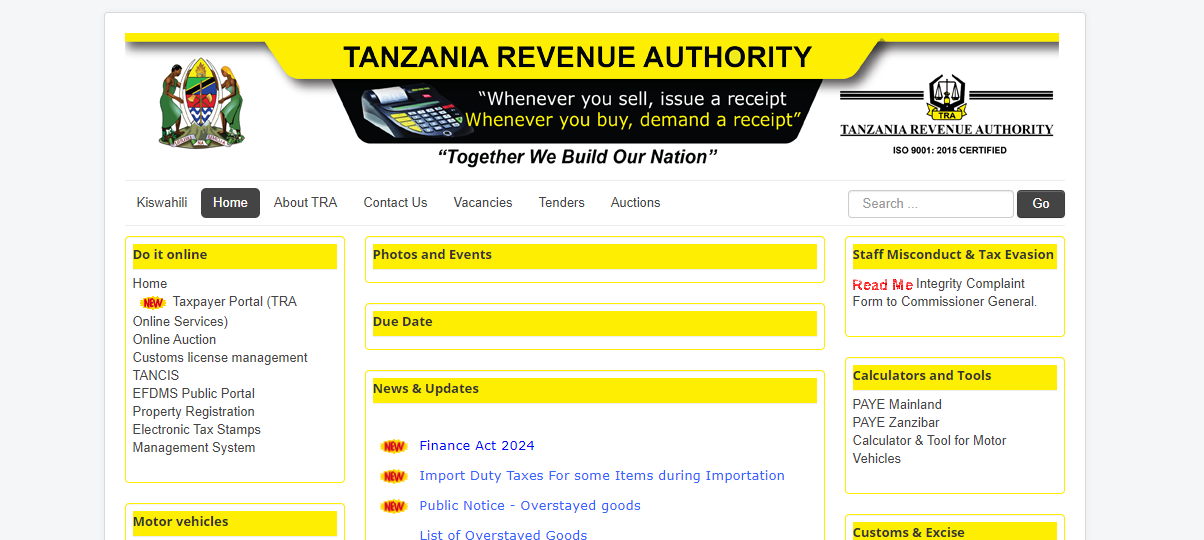

The registration process begins with gathering the necessary identification documents, such as a National Identification Number or other valid IDs. Once these documents are ready, individuals can access the Tanzania Revenue Authority Taxpayer Portal to start their application. This online platform simplifies the registration and ensures entrepreneurs can manage their tax obligations efficiently.

With a Business TIN, business owners can focus on growth and compliance in the Tanzanian market. This number not only facilitates tax tracking but is also vital for any future dealings with government authorities.

Understanding the Business TIN in Tanzania

A Business TIN (Tax Identification Number) is essential for any business operating in Tanzania. It serves as a unique identifier assigned to each taxpayer, streamlining tax processes and obligations. This section explores what a TIN is and why it is crucial for businesses.

Definition of TIN

A Tax Identification Number (TIN) is a unique number issued by the Tanzania Revenue Authority (TRA) to individuals or entities involved in economic activities. It plays a vital role in tax tracking and compliance.

Every business must apply for a TIN before starting operations. The TIN is used for various purposes, including filing taxes, opening a bank account, and applying for licenses. Obtaining it is often a straightforward process that helps ensure legal and financial transparency in business activities.

Importance of TIN for Businesses

The Business TIN is imperative for several reasons. First, it allows businesses to conduct tax transactions with the TRA effectively. Without a TIN, companies face challenges in fulfilling their tax obligations.

Additionally, a TIN is required to open a corporate bank account. Financial institutions typically request this number to comply with regulations. A TIN also aids businesses in applying for permits and licenses, essential for operations in Tanzania.

Moreover, possessing a TIN enhances a business’s credibility. It demonstrates compliance with tax laws, fostering trust among clients and partners. Businesses with a TIN are more likely to access government services and support programs aimed at enhancing economic growth.

Jinsi ya kupata TIN Namba yangu ya Biashara| How to Get My Business TIN Number

Acquiring Your Business TIN

Obtaining a Taxpayer Identification Number (TIN) is essential for businesses in Tanzania. This section details the requirements, necessary documents, registration process, and how to verify and collect the TIN.

Eligibility Criteria for Obtaining TIN

To acquire a TIN in Tanzania, the applicant must meet specific criteria. The business must be registered in Tanzania, either as a sole proprietorship, partnership, or corporation. Additionally, the owner or director should possess a valid National Identification Number (NIN). Businesses that operate in various sectors, including services, trade, and manufacturing, are eligible.

Foreign investors who plan to start a business in Tanzania also qualify for a TIN. They must provide documentation proving their residency status or work permit. Meeting these conditions ensures that the applicant can successfully apply for a TIN.

Required Documents for TIN Application

Several documents are needed for a successful TIN application. The primary document is the application form, which can be obtained from the Tanzania Revenue Authority (TRA) website. Applicants must also submit a valid National Identification Number (NIN).

Here is a list of additional required documents:

- Certificate of Incorporation: For registered businesses.

- Partnership Agreement: If applicable.

- Lease Agreement or Title Deed: For business premises.

- Tax Payment Receipts: If the business is already operational.

Having these documents ready is crucial for a smooth application process.

Steps for Online TIN Registration

The online registration process for obtaining a TIN is straightforward. First, visit the TRA website and look for the “Apply for TIN” option. The applicant will have to fill out an online form.

Key steps include:

- Entering Personal Information: Provide accurate details, including the NIN.

- Submitting Documents: Upload the required documents in digital format.

- Review and Submit: Double-check the entered information before applying.

After submission, the applicant will receive a confirmation message. This step ensures that the application is being processed.

Verification and Collection Process

Once the TIN application is processed, the TRA will verify the submitted information. This involves checking the authenticity of the documents provided. The verification process typically takes a few days.

After successful verification, the applicant will be informed via email or SMS. They will be instructed on how to collect the TIN. In some cases, the TIN can be issued online. Applicants need to keep track of their application status to ensure timely collection.